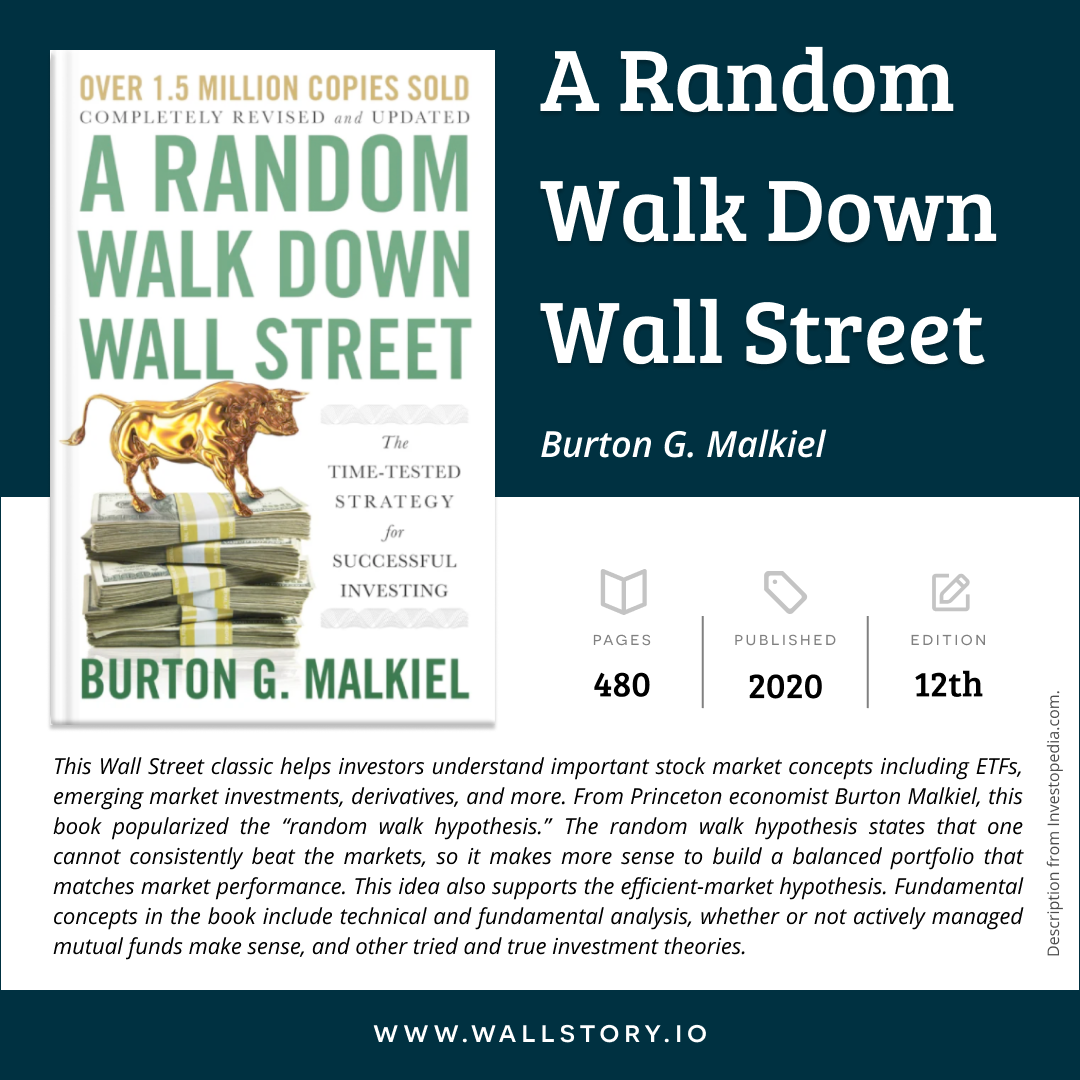

This Wall Street classic helps investors understand important stock market concepts including ETFs, emerging market investments, derivatives, and more. From Princeton economist Burton Malkiel, this book popularized the “random walk hypothesis.” The random walk hypothesis states that one cannot consistently beat the markets, so it makes more sense to build a balanced portfolio that matches market performance. This idea also supports the efficient-market hypothesis. Fundamental concepts in the book include technical and fundamental analysis, whether or not actively managed mutual funds make sense, and other tried and true investment theories. Description from Investopedia.com.