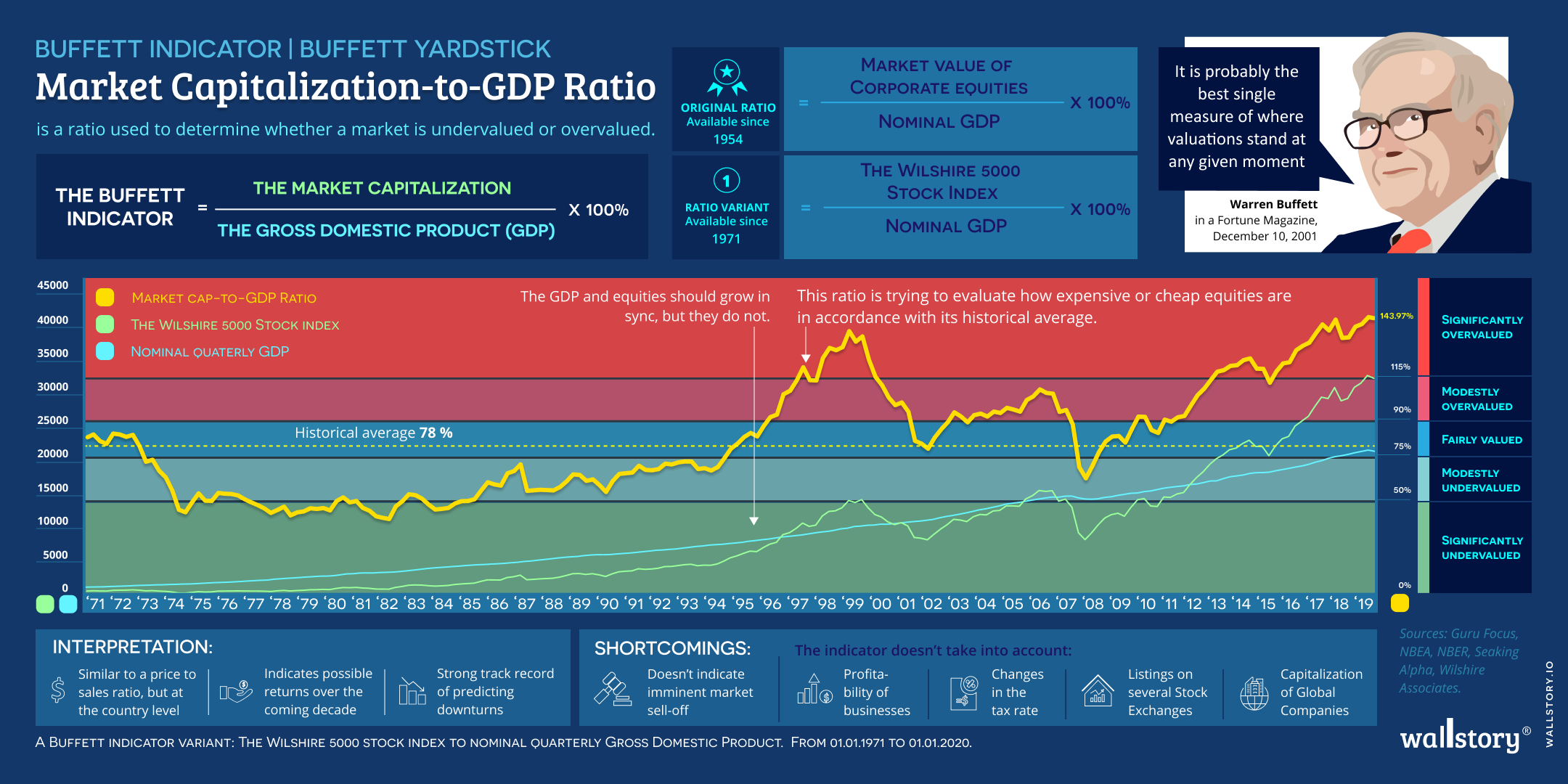

The Buffett indicator, also known as the Total Market Cap to Gross Domestic Product (GDP) ratio, is a measure used to assess the overall value of the stock market in comparison to the size of the underlying economy. The indicator is calculated by dividing the total market capitalization of all publicly traded companies by the GDP of a country. A high ratio indicates that the stock market is overvalued, while a low ratio suggests that it is undervalued. The idea behind the Buffett indicator is that a country's stock market should not be worth more than its underlying economy, as the market capitalization represents the value of all the goods and services produced by the country. The indicator is named after the famous investor Warren Buffett, who has often used it as a gauge for market valuations.