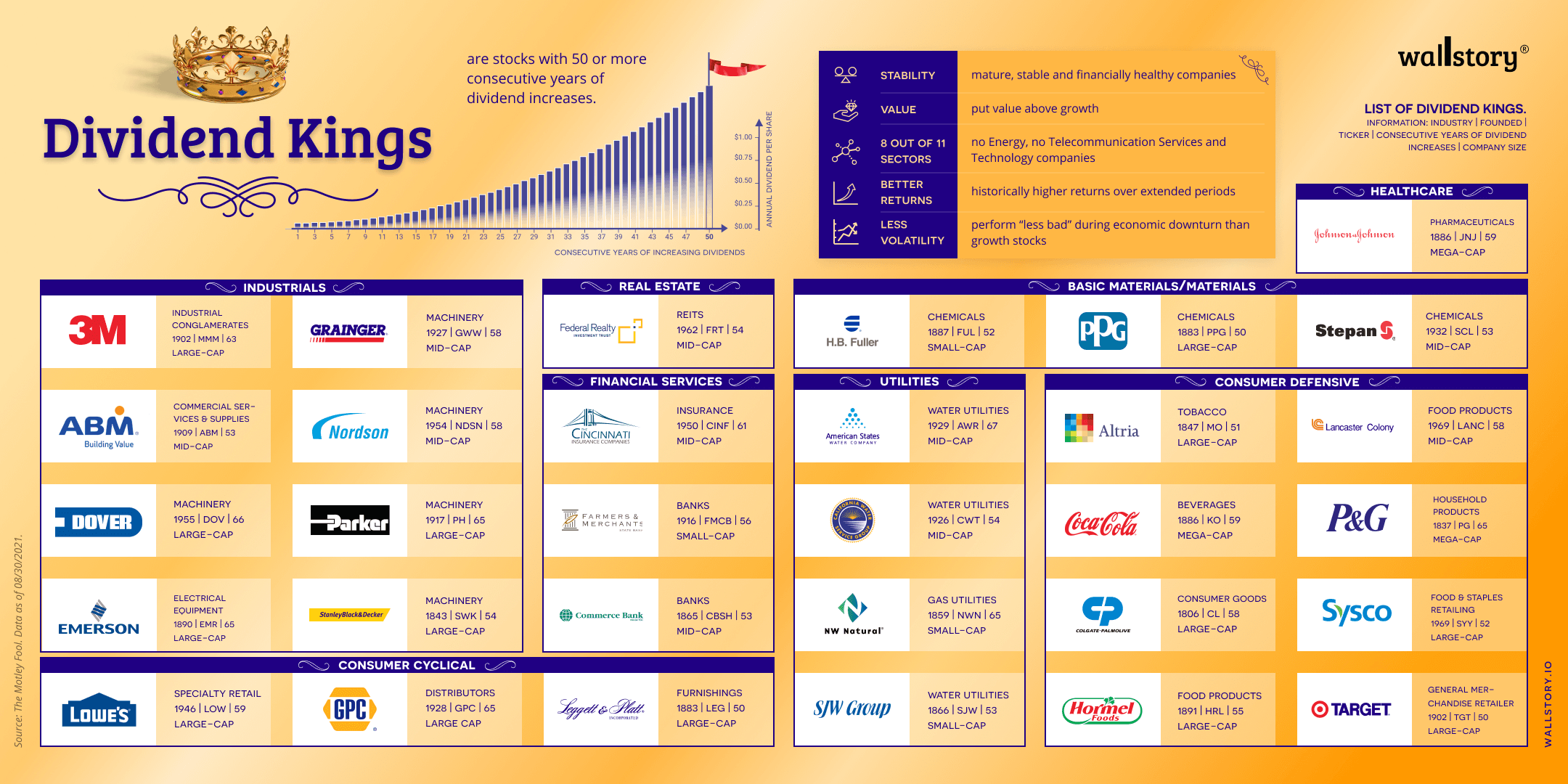

Dividend Kings are a group of blue-chip stocks that have a long history of consistently increasing their dividends over a period of at least 50 years. These stocks are considered to be some of the safest and most reliable investments for income-seeking investors. The length of a company's dividend-increasing streak is a testament to its financial stability, profitability, and commitment to shareholder returns. Dividend Kings are typically large, well-established companies in stable industries such as utilities, consumer goods, and healthcare. These companies have a strong track record of generating steady earnings and cash flows, allowing them to consistently increase their dividends year after year. Owning Dividend Kings in a portfolio can provide a reliable source of income and stability, as well as potential capital appreciation over the long term. It's important to note that while Dividend Kings have a long history of dividend increases, there is no guarantee that they will continue to do so in the future. As with any investment, it is important to thoroughly research a company and its financials before making a decision.