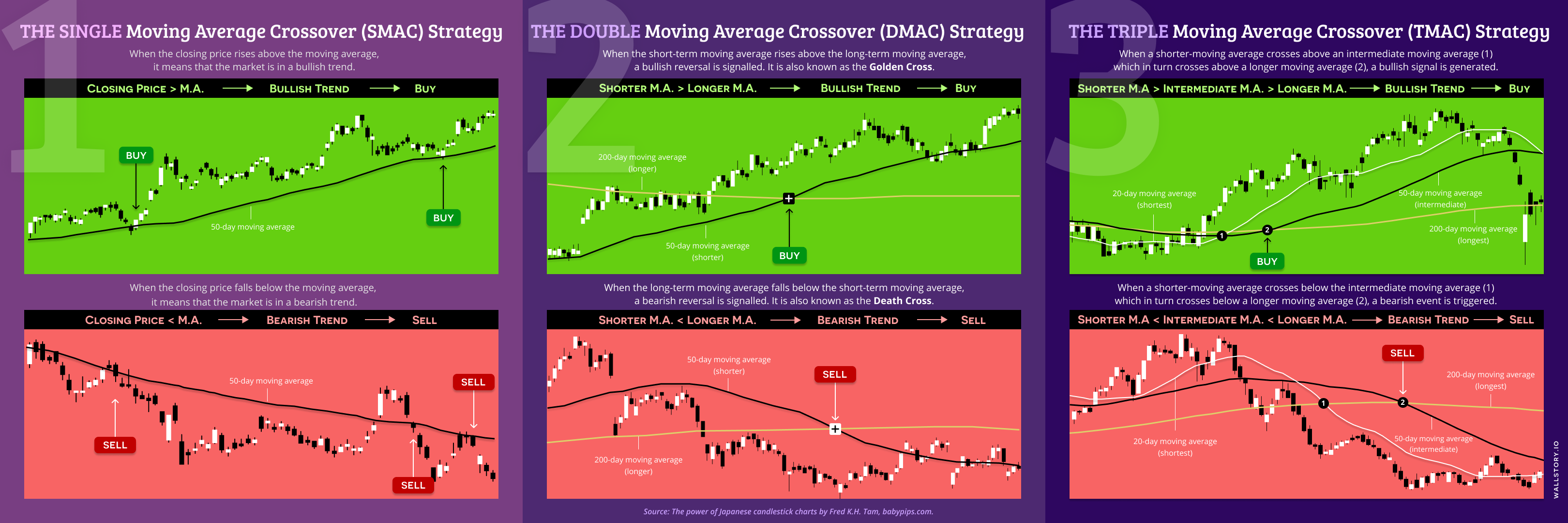

The Double Moving Average Crossover Strategy is a technical analysis trading strategy that involves using two moving averages of different time periods to identify potential buy and sell signals in the stock market. The strategy works as follows:

- A short-term moving average, such as a 20-day moving average, is used to reflect short-term price trends and volatility.

- A long-term moving average, such as a 50-day or 200-day moving average, is used to reflect long-term price trends and volatility.

A potential buy signal is generated when the short-term moving average crosses above the long-term moving average, and a potential sell signal is generated when the short-term moving average crosses below the long-term moving average. The crossing of the two moving averages is considered to be an indication of a change in trend.