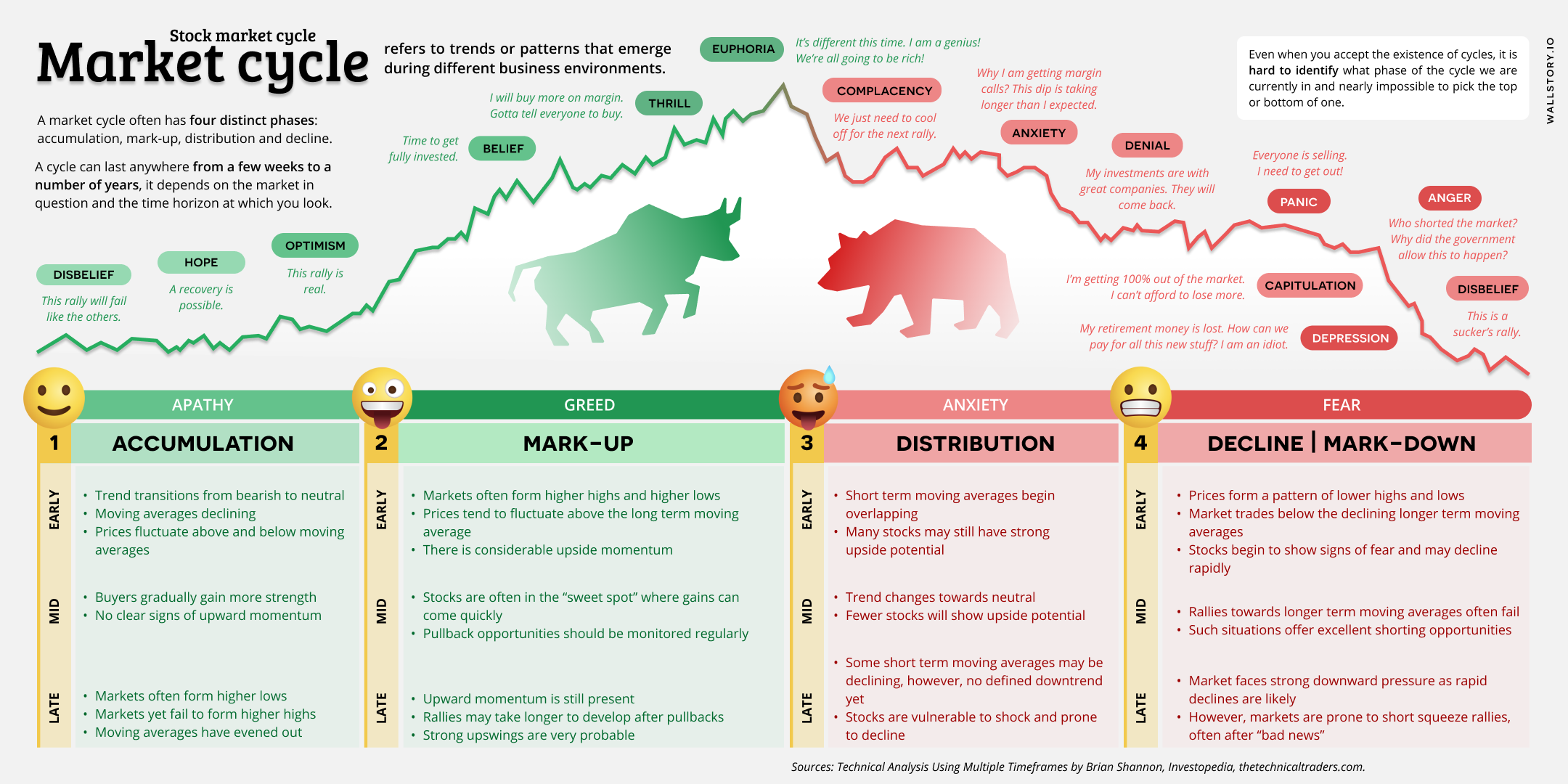

A market cycle refers to the recurring sequence of periods of growth and decline that stock market prices tend to follow. It's characterized by changes in investor sentiment and behavior that drive changes in market conditions, which in turn influence prices. Market cycles usually last several years, and they are influenced by various economic, political, and social factors. The stages of a market cycle can include expansion, peak, contraction, and trough. During the expansion phase, prices tend to rise as economic growth and investor confidence increase. In the peak stage, prices reach their highest point and start to decline as the economy slows and investors become more cautious. The contraction phase is characterized by declining prices and lower levels of economic activity, while the trough phase is the bottom of the cycle, when prices are at their lowest and the economy is starting to recover. Understanding market cycles can help investors make informed investment decisions and potentially capitalize on market trends.