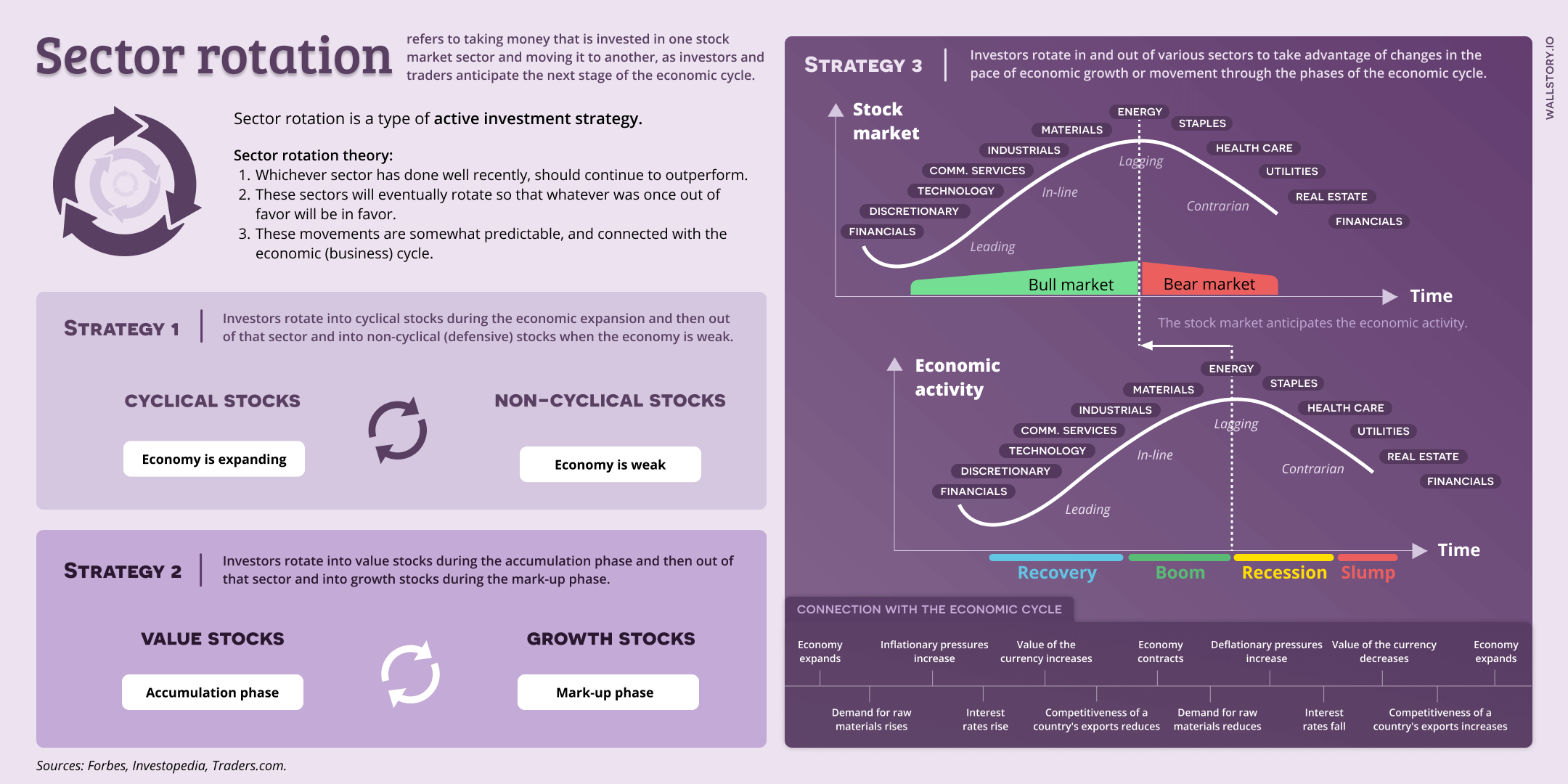

Sector rotation is a strategy in which an investor shifts their investments among different sectors of the stock market in response to changes in market conditions. The idea behind sector rotation is to capitalize on the performance of sectors that are growing, while avoiding sectors that are declining. This strategy is based on the belief that different sectors of the stock market tend to perform well at different times, and that by rotating into sectors that are outperforming and out of sectors that are underperforming, an investor can potentially increase their returns. Sector rotation can be done manually or through the use of sector rotation mutual funds or exchange-traded funds (ETFs) that automatically adjust their portfolios based on market trends. This strategy can be useful for investors looking to balance their portfolios, manage risk, and capitalize on market opportunities, but it also requires close monitoring and a good understanding of market trends and conditions.