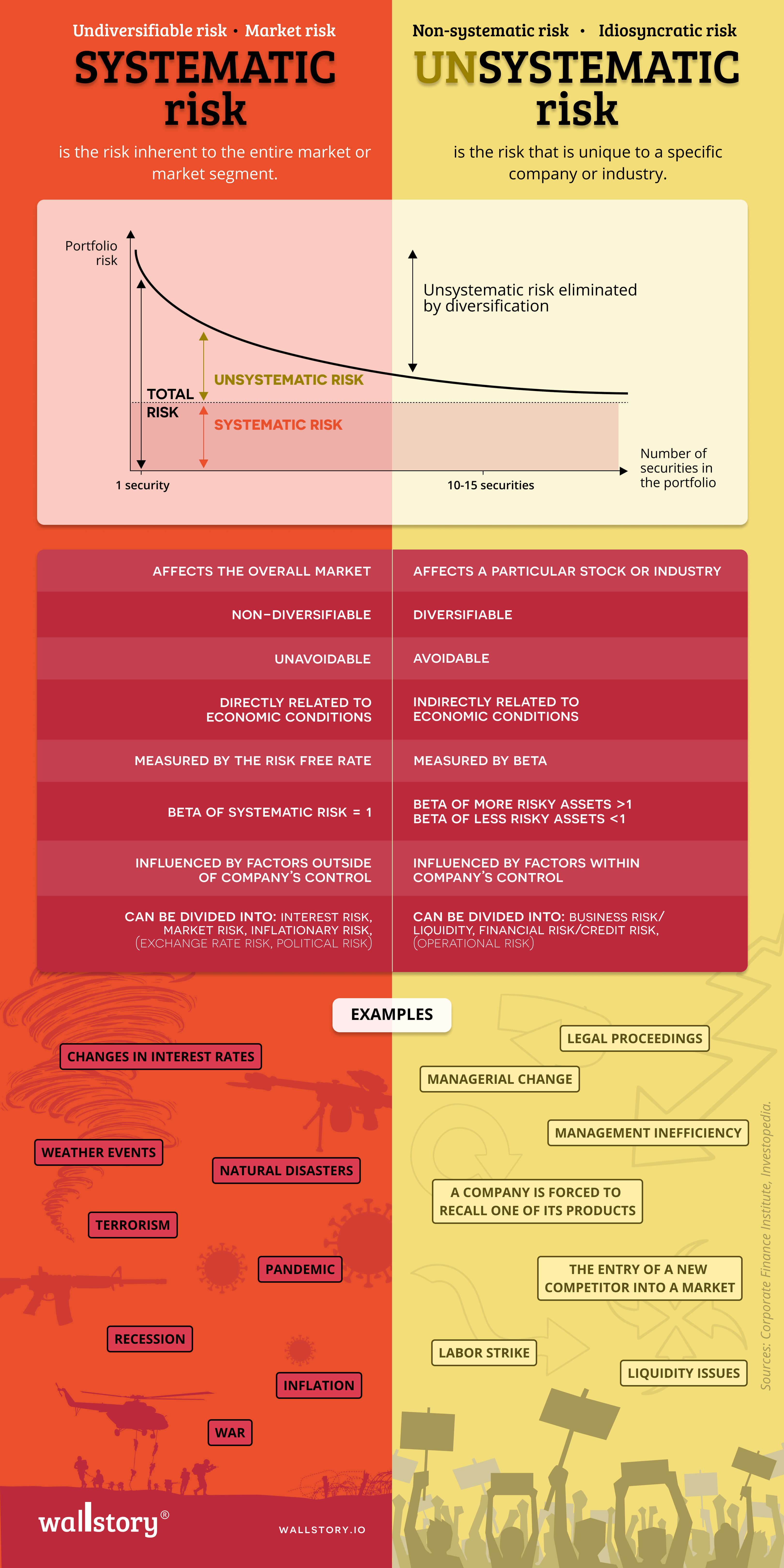

Systematic risk, also known as market risk, is the risk that is inherent to the overall market and cannot be diversified away. It is the risk that affects all investments in a market and is caused by events such as economic recessions, changes in interest rates, natural disasters, or geopolitical events. Systematic risk is often considered to be beyond the control of investors and cannot be eliminated through diversification. Systematic risk affects the overall market and all the investments within it, so it cannot be avoided by holding a diversified portfolio. Instead, investors can manage systematic risk by holding a well-diversified portfolio and by adjusting their investment strategies based on market conditions.