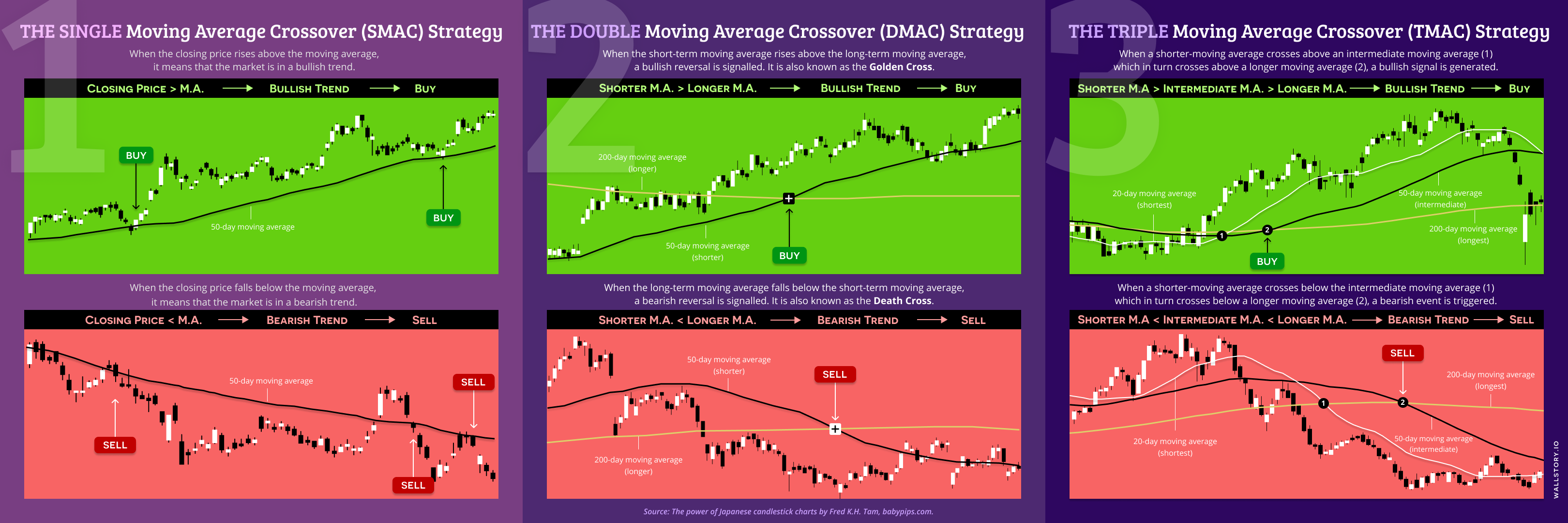

The Triple Moving Average Crossover Strategy is a technical analysis trading strategy that involves using three moving averages of different time periods to identify potential buy and sell signals in the stock market. The strategy works as follows:

- A short-term moving average, such as a 20-day moving average, is used to reflect short-term price trends and volatility.

- A medium-term moving average, such as a 50-day moving average, is used to reflect intermediate price trends and volatility.

- A long-term moving average, such as a 200-day moving average, is used to reflect long-term price trends and volatility.

A potential buy signal is generated when the short-term moving average crosses above the medium-term moving average, and a potential sell signal is generated when the short-term moving average crosses below the medium-term moving average. The long-term moving average is used as a filter to confirm the trend and the validity of the buy and sell signals.