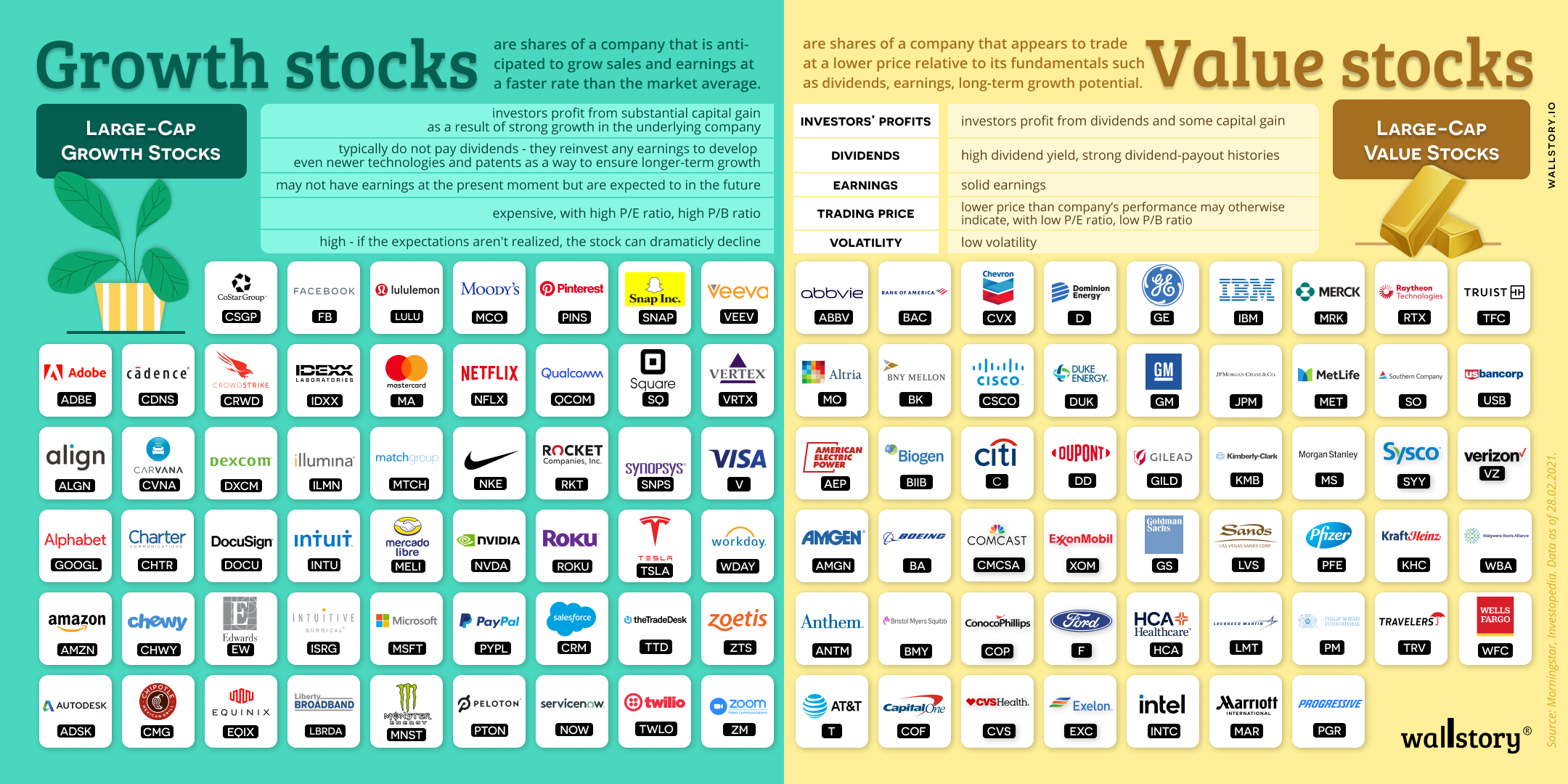

Value stocks are shares of companies that are considered to be undervalued by the market based on various financial metrics, such as price-to-earnings ratio, price-to-book ratio, and dividend yield. Investors who invest in value stocks are betting that the market will eventually recognize the company's true worth, leading to an increase in stock price. Value stocks are often associated with mature, established companies in stable industries, such as utilities, consumer goods, and financial services. These companies may be experiencing temporary challenges or have a lower growth rate compared to growth stocks, but they typically have a strong financial foundation and a history of profitability. Investing in value stocks can provide potential for capital appreciation, as well as a steady stream of dividends. Value stocks are generally considered to be less volatile and less risky compared to growth stocks, but they may also have lower returns in the short term. As with any investment, it is important to thoroughly research a company and its financials before making a decision.