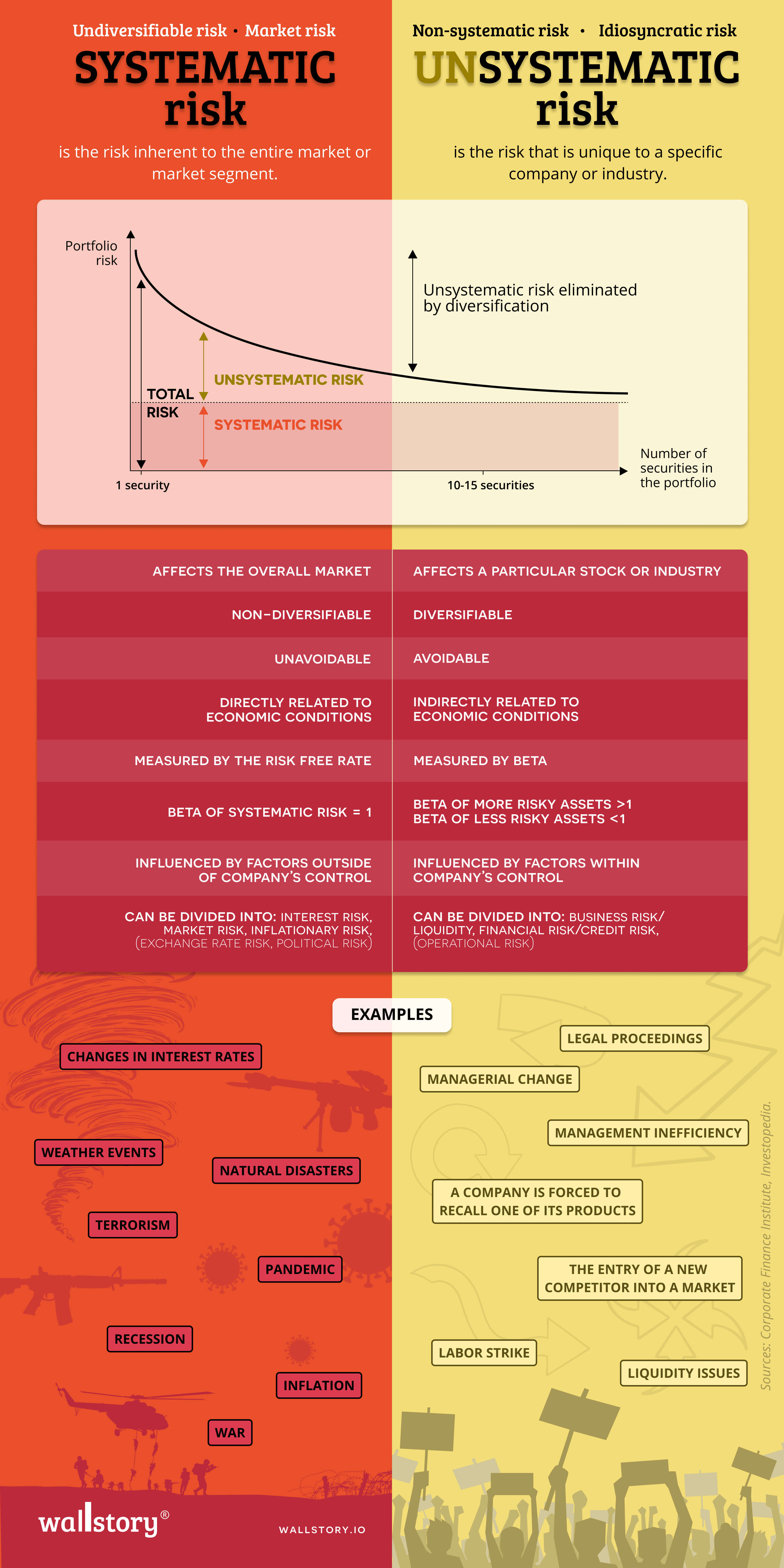

Unsystematic risk, also known as specific risk or diversifiable risk, is the risk that is specific to a particular company, industry, or security. It is the risk that is unique to a company or a portfolio of investments and is not correlated with the overall market. Examples of unsystematic risk include changes in management, product recalls, lawsuits, and technological advancements that could negatively impact the performance of a specific company or sector. Unsystematic risk can be reduced through diversification, where an investor spreads their investments across different companies, industries, and asset classes. This helps to reduce the impact of any specific risk to the portfolio as a whole.