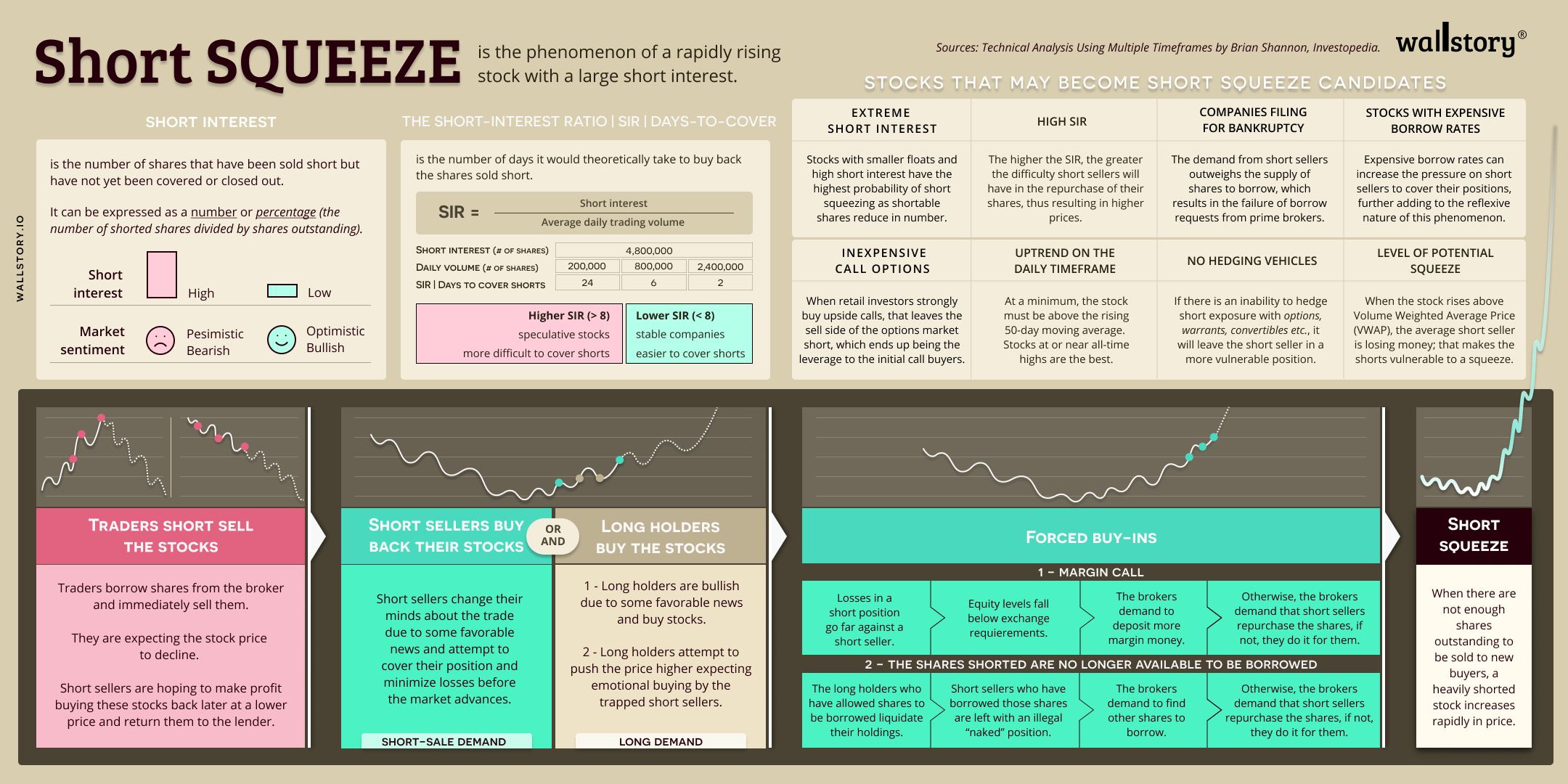

A short squeeze is a situation in which a heavily shorted stock suddenly rises in price, forcing traders who have bet that the stock would fall (short sellers) to buy shares to cover their positions and limit their losses. This buying pressure can drive the stock's price even higher, causing short sellers to incur even larger losses and leading to a vicious cycle that further exacerbates the short squeeze. A short squeeze can occur when a positive catalyst, such as positive earnings or a favorable analyst report, leads to increased buying demand for a stock, or when short sellers are forced to cover their positions due to a margin call or a change in market sentiment. The sudden surge in buying demand can push the stock's price higher, triggering stop-loss orders and further exacerbating the short squeeze.