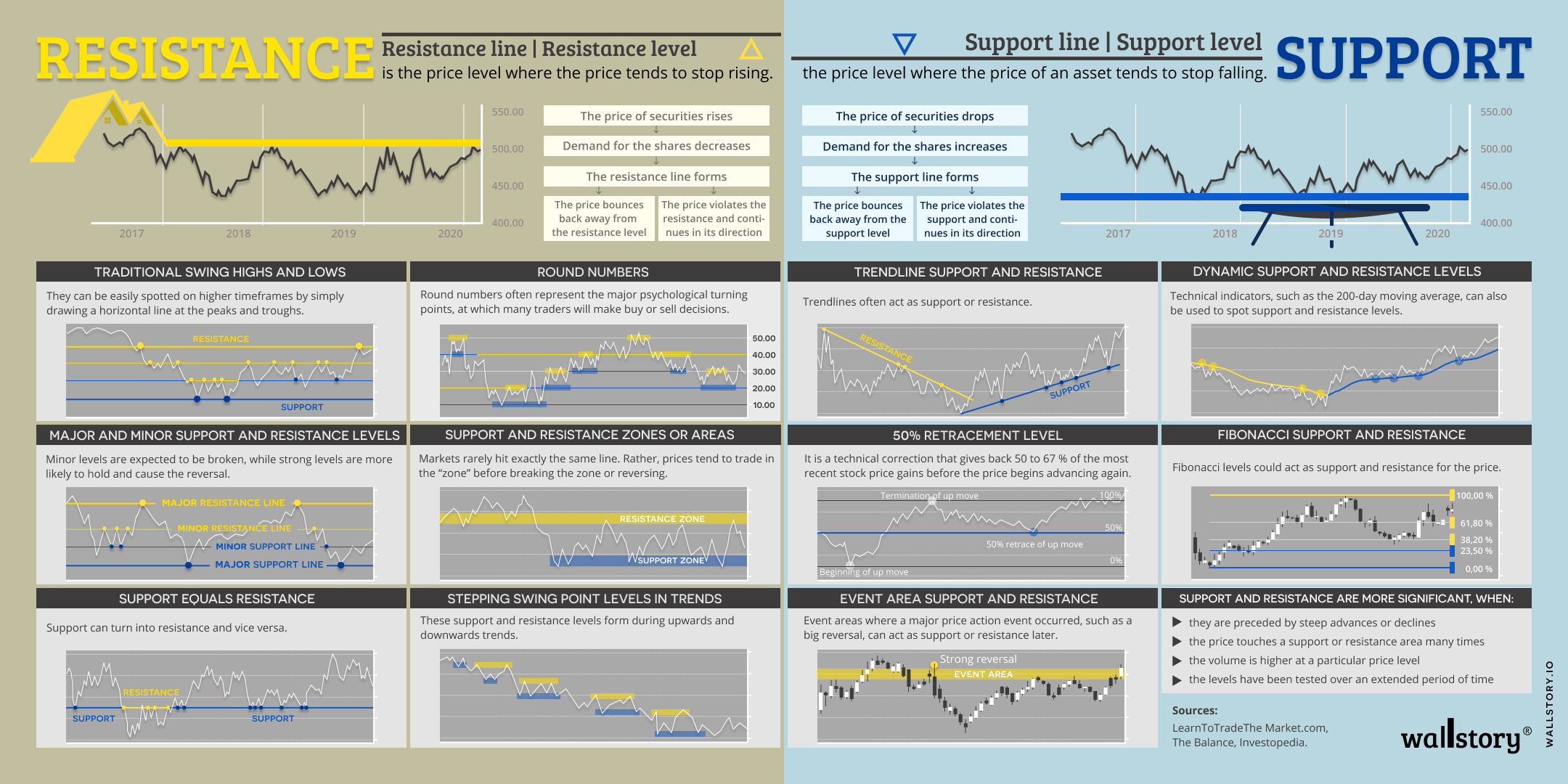

In trading, resistance refers to a price level at which demand for a stock or other security is thought to be weak enough to prevent the price from rising further. Resistance levels are often determined by analyzing past price movements and identifying areas where sellers have consistently stepped in to sell the security and prevent a further increase in price. Resistance levels can act as a ceiling for a stock's price, and if the stock's price rises to a resistance level and then starts to fall, this is seen as a bearish sign. On the other hand, if the stock's price rises through a resistance level, this can be seen as a bullish signal and an indication that the trend may be shifting from bearish to bullish. Traders and investors use resistance levels as a key factor in determining entry and exit points for trades, and as a way to set profit targets.